Wolfspeed reports Q2 results

US SiC speclaiist Wolfspeed has announced its results for the second quarter of fiscal 2026 with a consolidated revenue of approximately $168m (Mohawk Valley Fab: $76m).

GAAP gross margin was (46) percent and Non-GAAP gross margin of (34) percent. GAAP net loss was $151m and adjusted EBITDA of ($82)m.

The company reports $1.3b of cash, cash equivalents and short term investments as of December 28, 2025.

These results follow Wolfspeed's emergence from a voluntary proceeding under Chapter 11 of the US Bankruptcy Code on September 29, 2025.

“With a stronger capital structure following our financial restructuring, we are operating with discipline to maintain balance sheet strength while upholding our commitment to disruptive innovation,” said Wolfspeed CEO Robert Feurle.

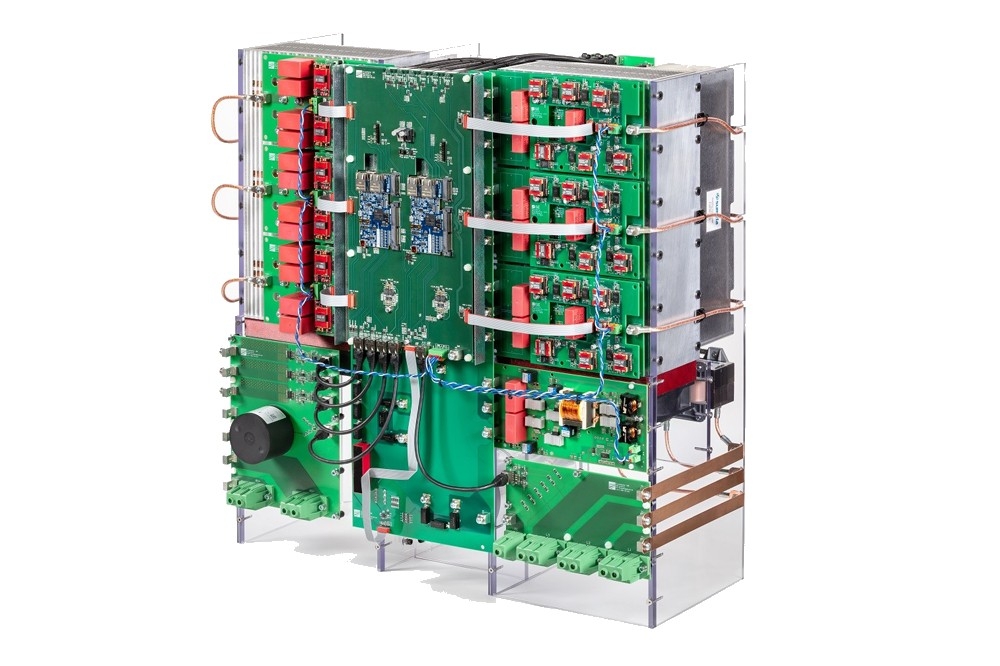

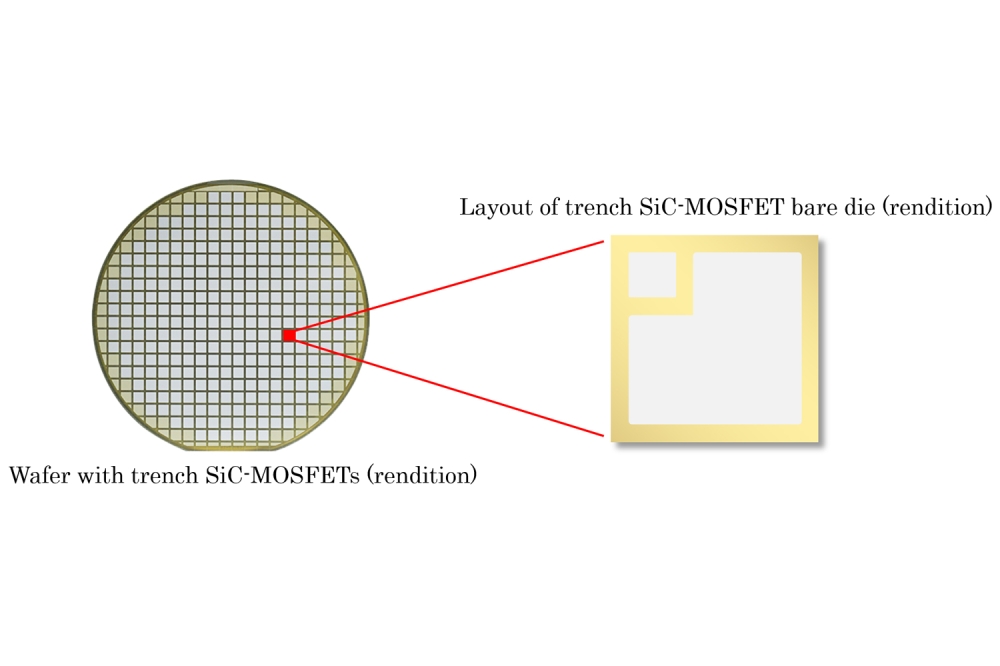

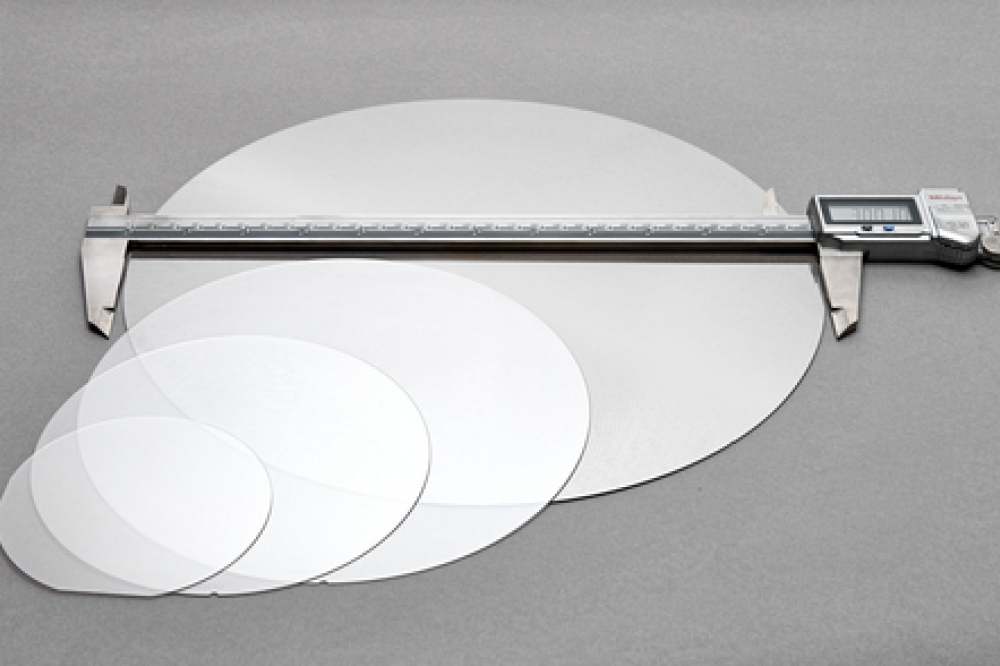

"We completed the shutdown of our Durham 150mm device fab roughly one month ahead of schedule and have shifted production to our 200mm device fab in Mohawk Valley, while also continuing to diversify our end-markets, particularly in mid and high-voltage verticals like AI data centres, where we generated 50 percent sequential quarterly revenue growth.

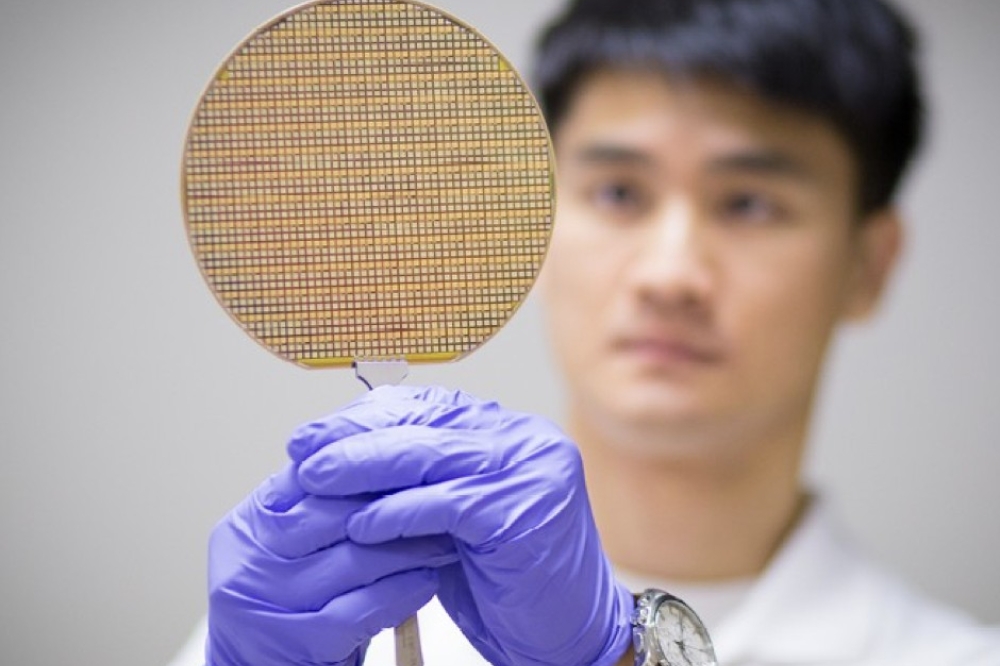

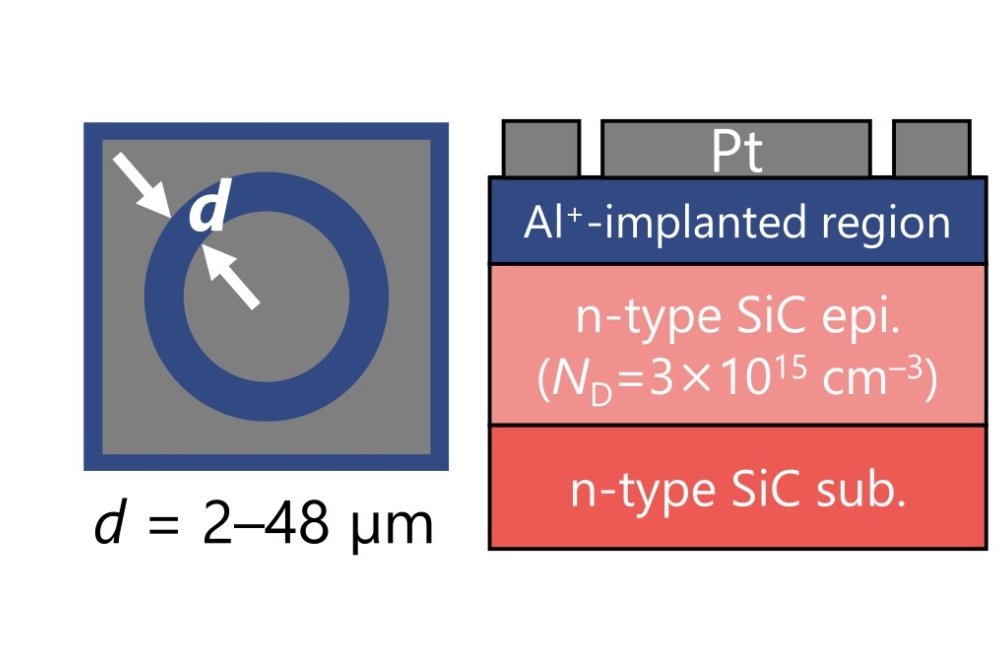

"In materials, we demonstrated our capabilities in 300mm SiC wafer production, a critical step towards entering emerging markets beyond power devices. I am very excited that we now have the team and structure in place to navigate near-term demand dynamics and execute with discipline as we scale for long-term growth.”

Wolfspeed CFO Gregor van Issum added, “During the quarter, we took decisive actions to strengthen our balance sheet. First, we maximised the value of our 48D Advanced Manufacturing Tax Credit, receiving approximately $700m ahead of schedule. We used some of the proceeds to retire approximately $175m of outstanding debt, an important step to reduce our leverage and interest expense.

"Next, we drove strong working capital improvements by proactively aligning production with the current demand environment leading to a reduction in inventory and improving our receivables position. Lastly, we significantly improved operating cash flow performance by reducing operating expenses by $200m on an annualised basis and capital expenditures by more than 90 percent compared to the same quarter last year. Going forward, we will continue to execute operational improvements centreed on quality, cost and speed.”

Business 0utlook

The company expects to generate revenue between $140m and $160m for its fiscal third quarter. The decline is driven by accelerated fiscal first half customer purchases, as certain customers built up inventory by placing orders from the Durham fab prior to its planned closure at year-end, certain customers pursuing second sourcing of products during Wolfspeed’s bankruptcy process and weaker EV demand.

The company expects operating expenses to be flat to slightly down sequentially, as management remains focused on controlling operating costs through actions already implemented.

Due to ongoing fresh start accounting impacts, Wolfspeed says it will not provide numeric gross margin guidance, but does expect further quarter over quarter improvement driven by ongoing operational actions. Gross margin is expected to remain negative in fiscal third quarter.