Wolfspeed reports Q1 results

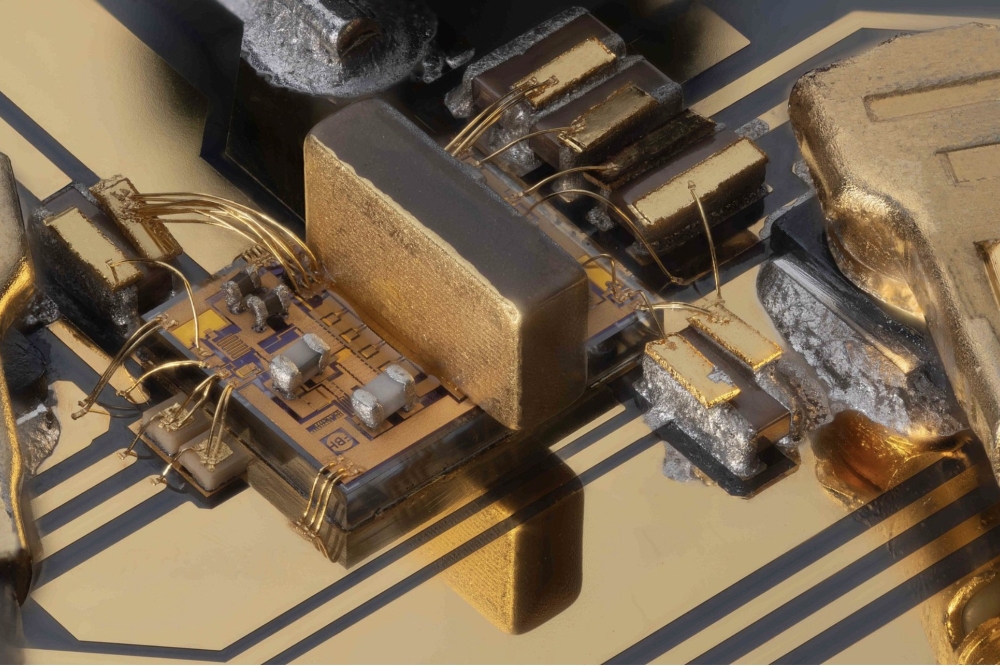

SiC specialist Wolfspeed has announced its results for the first quarter of fiscal 2026 after emergence from Chapter 11 and a process of restructuring.

Consolidated revenue was approximately $197 million, compared to $195 million in Q1 2025. Of this revenue, the Mohawk Valley Fab contributed $97 million, compared to $49 million in Q1 2025. GAAP gross margin was -39 percent, compared to -19 percent in Q1 2025. Non-GAAP gross margin was -26 percent, compared to 3 percent in Q1 2025.

GAAP and non-GAAP gross margin includes the impacts of underutilisation costs related to the Mohawk Valley Fab and Siler City Fab. Underutilisation was $47 million, compared to $26 million. Prior to production readiness at the Siler City facility in late fiscal 2025, these costs associated with Siler City were presented as start-up costs.

GAAP loss per share was -$4.12, compared to -$2.23 in Q1 2025. This includes $504 million of Reorganisation Items related to the Chapter 11 cases, including $28 million of professional fees and $476 million of debt-related adjustments. Non-GAAP loss per share was -$0.55, compared to -$0.91 in Q1 2025

The company ended the quarter with $926 million of cash, cash equivalents & short-term investments.

“In my first months as CEO, I’ve been deeply impressed by the resilience and focus of the Wolfspeed team. Through our restructuring, we’ve strengthened the foundation of the company, emerging as a leaner organisation with a focus on product innovation and market leadership," said Wolfspeed CEO Robert Feurle.

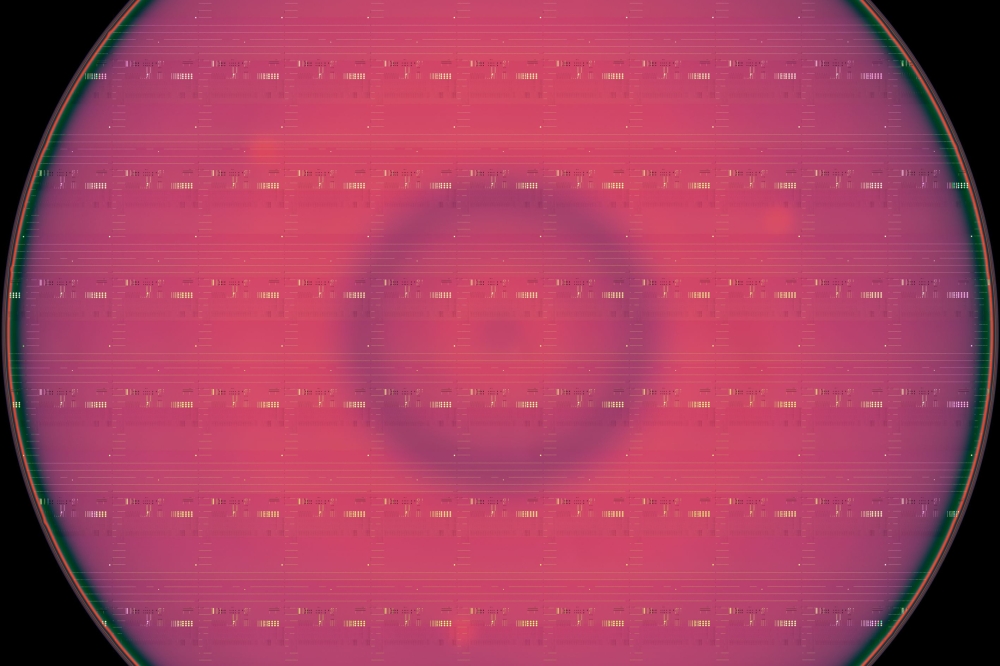

Feurle continued, “We’re building a stronger Wolfspeed that capitalises on our world-class 200mm manufacturing footprint and leadership in SiC. As we look ahead, we’re taking a disciplined approach to align the business with the near-term headwinds while advancing into new, high-growth applications like AI data centres, aerospace, and energy storage. We believe these actions position Wolfspeed to deliver sustainable growth and long-term value.”

Business outlook

Wolfspeed expects a sequential decline in revenue. The company expects to generate revenue between $150 million and $190 million for its fiscal Q2, driven primarily by accelerated customer purchases in Q1, as certain customers built up inventory by placing orders from the Durham fab prior to its planned closure at year-end, and by customers pursuing second-sourcing of products during the pendency of Wolfspeed’s bankruptcy process.

In addition, in line with others in the industry, Wolfspeed says it has experienced ongoing softness in the market that it expects will continue through fiscal 2026.