Navitas pivots to high-power markets

Navitas Semiconductor has announced unaudited financial results for Q3 ended September 30, 2025, with total revenue of $10.1m, compared to $21.7m in Q3 2024 and $14.5m in the Q2 2025.

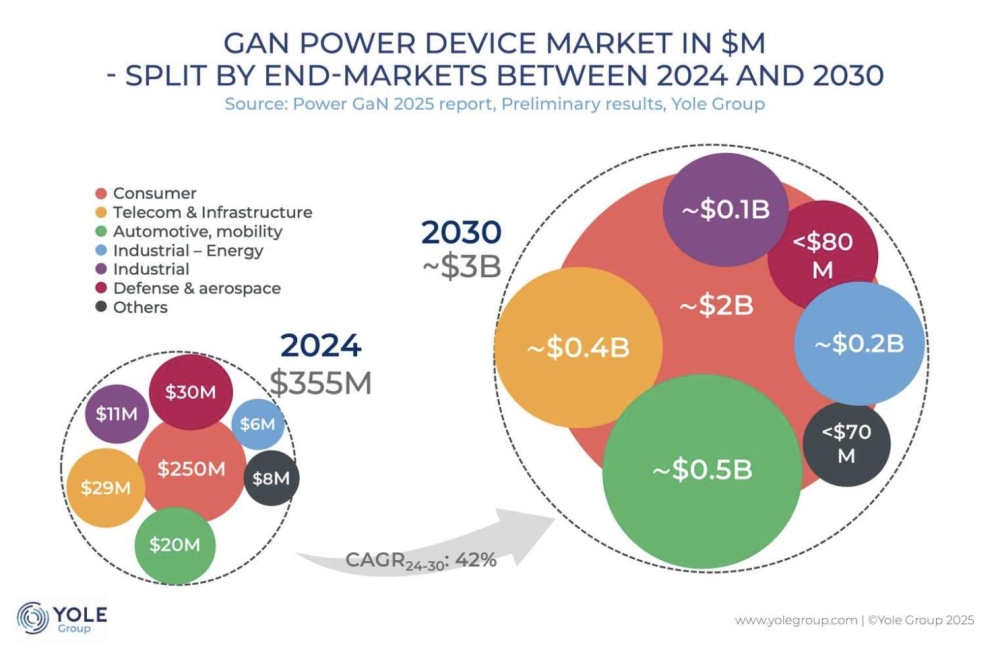

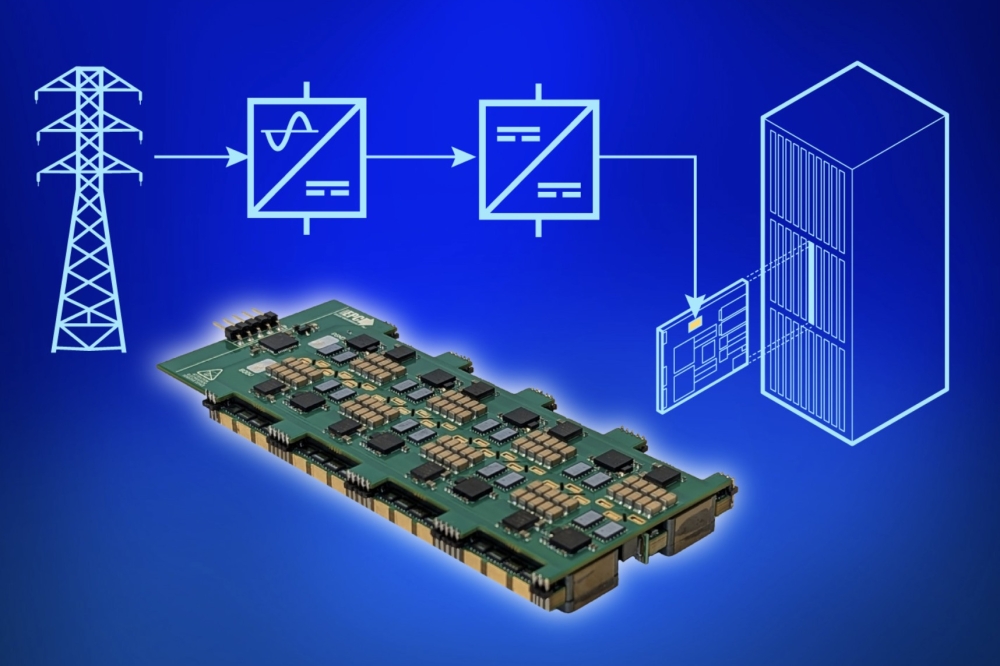

With these disappointing results, Chris Allexandre, president and CEO, said the company would be pivoting towards higher power markets: AI data centres, performance computing, energy/grid infrastructure, and industrial electrification. He called the change 'Navitas 2.0'.

“Navitas’ decade-long technology leadership in GaN, and high-voltage SIC strongly positions us to capitalise on these global megatrends. We are executing a strategic pivot from consumer and mobile markets to these fast-growing, more profitable, more sustainable higher-power segments," he said.

“Our rapid and decisive actions around resource reallocation, product roadmap, and go-to-market changes are designed to deliver better results, enhance the scale and quality of our business and create long-term value for our customers, employees, and stockholders.”

GAAP loss from operations for the quarter was $19.4m, compared to a loss of $29.0m for Q3 2024 and a loss of $21.7m for Q2 2025. On a non-GAAP basis, loss from operations for the quarter was $11.5m compared to a loss of $12.7m for Q3 2024 and a loss of $10.6m in Q2 2025.

Cash and cash equivalents were $150.6m as of September 30, 2025.

Over the last quarter, Navitas has been recognised by NVIDIA as a power semiconductor partner for its next-generation 800V DC architecture in AI factory computing.

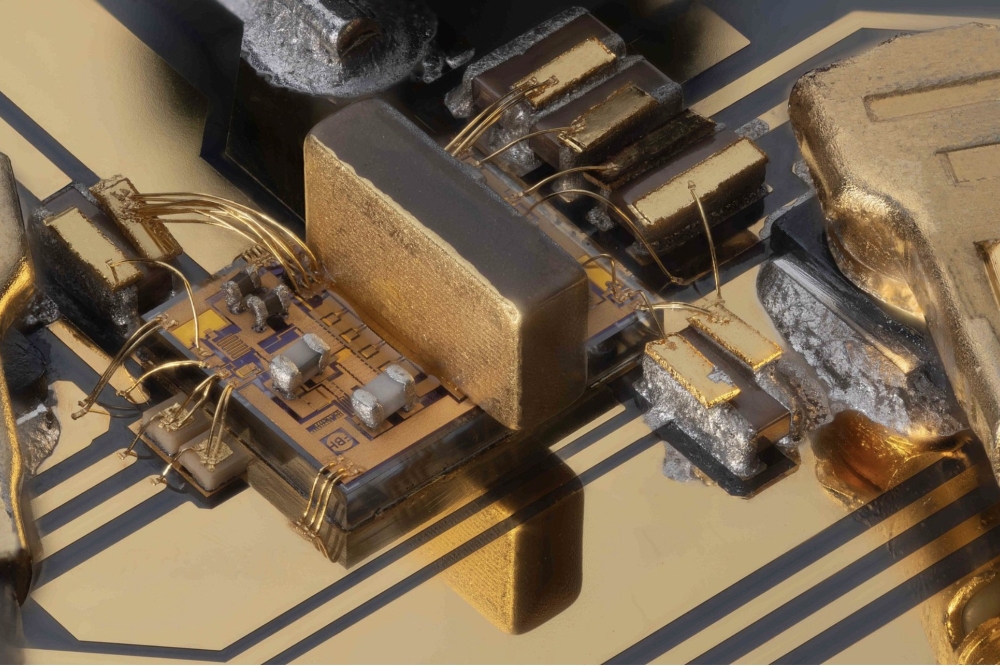

Navitas' newly introduced portfolio of 100V and 650V discrete GaNFast FETs, alongside its GaNSafe ICs and high-voltage, high-power SiC products, suit NVIDIA’s 800V DC AI factory power architecture and the rapid growth of high-power AI markets.

The company has also started sampling new 2.3kV and 3.3kV high-voltage SiC modules to leading energy-storage and grid-infrastructure customers.

Near term business outlook

Fourth quarter 2025 net revenues are expected to be $7.0m, plus or minus $0.25m due the company’s strategic decision to deprioritise low power, lower profit China mobile & consumer business, as well as streamline itsdistribution network and reduce channel inventory to pivot to higher power revenue and customers.

Non-GAAP gross margin for Q4 is expected to be 38.5 percent plus or minus 50 basis points, and non-GAAP operating expenses are expected to be approximately $15.0m in the fourth quarter of 2025.